Receive $10 OFF your service with Evans & Associates Inc. Tax & Accounting Service when you mention this website.

FREE consultations are available upon request, just call us at:

Download IRS2Go for your mobile device.

IRS2Go is available in both English and Spanish.

Read Through Our FAQs to Learn More

Read through our FAQs below for information on filing for tax returns. If you have any other doubts, then call our friendly staff on 478-453-2669 right away for help. We've proudly served the citizens of Central Georgia with personal and efficient tax filing services since 1986!

How much do I have to make before filing?

The amount of money you have to earn before it is required that you file for tax returns varies for each individual. The calculation is based on your marital status, age, and whether you're filing jointly or separately.

Call our tax professionals for more information regarding filing requirements.

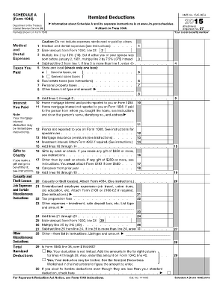

How much do I need to itemize?

Call for details, it varied from tax year to tax year.

What can I itemize?

The most common itemized deductions include but are not limited to:

- Personal property tax

- Tax return preparation fees

- Vehicle ad vol tax

- Union dues

- Medical expenses

- Real estate tax

- Home mortgage interest

- Charitable contributions

- Un-reimbursed work expenses

- Safe deposit box